Account for your real estate.

Track and record every cent going in and out of your business

Full accounting suite

Making sure that all transactions are accounted for is ultimately the main reason for managing property. Use this, instead of a separate accounting package to track transactions and generate/export all the necessary accounting data.

- Track tax obligations

- Fully-fledged, double-entry accounting system

- Import bank transactions from PDF/Excel

- Automatically map bank transactions

- Advanced reports

Advanced accounting reports & charts

Generate a wide range of accounting reports with the click of a button, ensuring that accuracy is always maintained. The reports include:

- Account list

- Account history

- Balance sheet

- Income statement

- Cashflow statement

- Tenant summary

- Trial balance

- Tax liability details

- Tenant summary

- General ledger

- Accounts receivable aging analysis

- Accounts payable aging analysis

- Bank reconciliation

- Tax summary

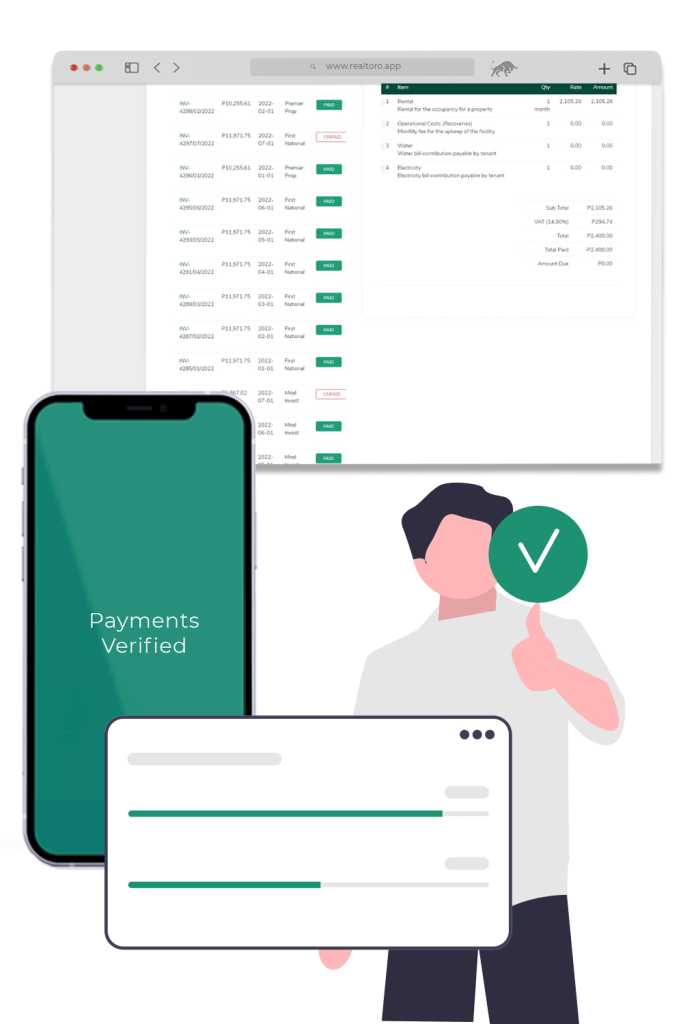

Payment approvals

As payments are received, they can be approved by the designated approver(s) to ensure that collections are indeed received, and rental delinquencies are minimized. Each notification request is sent as an email and/or push notification to the approver for them to act upon with speed.

Unapproved payments will not appear on the end-of-year accounting books until they have been approved and verified.

Import bank transactions

Ensure that your bank account is in-sync with your records by uploading the statement received from your bank into the system. Upon uploading, known transactions will be mapped to the associated accounts, while transactions which are unknown can be manually mapped to accounts with ease.

Bill expenses to tenants

During the month, certain tasks can be done which need to be paid – these expenses can be passed onto the tenant with ease, either in this month’s invoice, or any subsequent one.

Also, monthly expenses like water can be easily billed to each associated tenant by reading the water meter for each property, and having the system automatically create the necessary invoices for each tenant.

Tax liability

Both incoming and outgoing tax can be tracked with amazing accuracy, and reports denoting them can be created by those with the relevant access rights to do so.

Account reconciliations

Accounts can sometimes not always balance, and for this a reconciliation would need to be effected. This can be be done for any account, and the discrepancies will automatically be added as an associated reconciliation expense.

Export data

All data on the system can be exported by those with access rights. The data can be exported to Microsoft Excel, CSV or PDF for consumption in applications other than the RealToro system.